vehicle personal property tax richmond va

In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. In response to the higher values the Commissioner of the Revenue alerted other city officials and the City Council voted to lower the tax rate in 2022 on motor vehicles from 350.

How Much Virginia Personal Property Tax Bill We Pay For Multiple Cars Youtube

If you can answer YES to any of the following questions your vehicle is considered by.

. Code of Virginia 581 3668 B is very clear that the vehicle must be owned by either the veteran or jointly owned with the spouse. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

Jim Justice said Tuesday he will propose a plan to eliminate a personal property tax on vehicles. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for. If your vehicle is valued at 18030 the total tax would be 667.

Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and. An example provided by the City of Richmond goes like this. This situation is identical to the Disabled Veterans real estate.

You can report vehicles that may not be in compliance with registration and personal property tax laws online through Loudoun Express Request. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Personal Property Tax.

AP West Virginia Gov. Property taxes are a lien on the property that transfers with it. Boats trailers and airplanes are not prorated.

Is more than 50 of. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed.

At the calculated PPTRA rate of 30 you would be. You can also call the Commissioner of the. While Richmond offers either partial or full tax.

In Property taxes paid on average are 086 percent of the homes value. The county also can.

Richmond Auto Auction Anniversary Sale

Virginia S Personal Property Taxes On The Rise 13newsnow Com

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

Vehicle Personal Property Tax Faqs What Is

News Flash Chesterfield County Va Civicengage

Personal Property Vehicle Tax City Of Alexandria Va

Eliminating Virginia S Vehicle Property Tax Isn T Part Of Glenn Youngkin S Tax Relief Plan Wset

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

516 N 25th St Richmond Va 23223 Mls 2211154 Redfin

Used Honda Cars For Sale In Richmond Va Cars Com

Henrico First To Give Money Back For Personal Property Taxes Under Revised State Law

Virginia S Personal Property Taxes On The Rise 13newsnow Com

16 E Marshall St Richmond Va 23219 Retail For Sale Loopnet

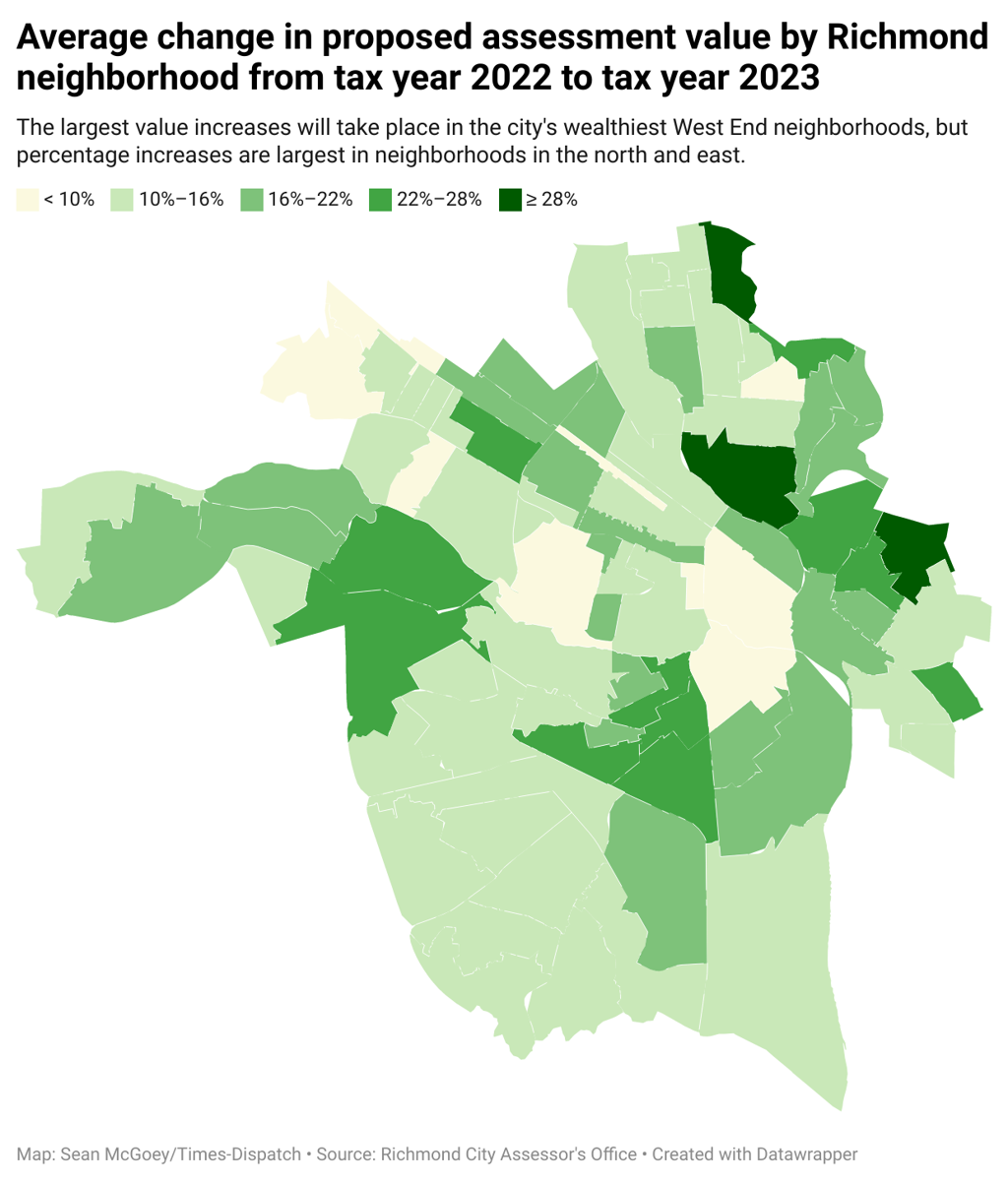

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Virginia Department Of Motor Vehicles

George Mason School Historic Richmond

Henrico County Announces Plans On Personal Property Tax Relief